Press release: For immediate release

Date: 10 June 2020

May brings some relief for the BETI

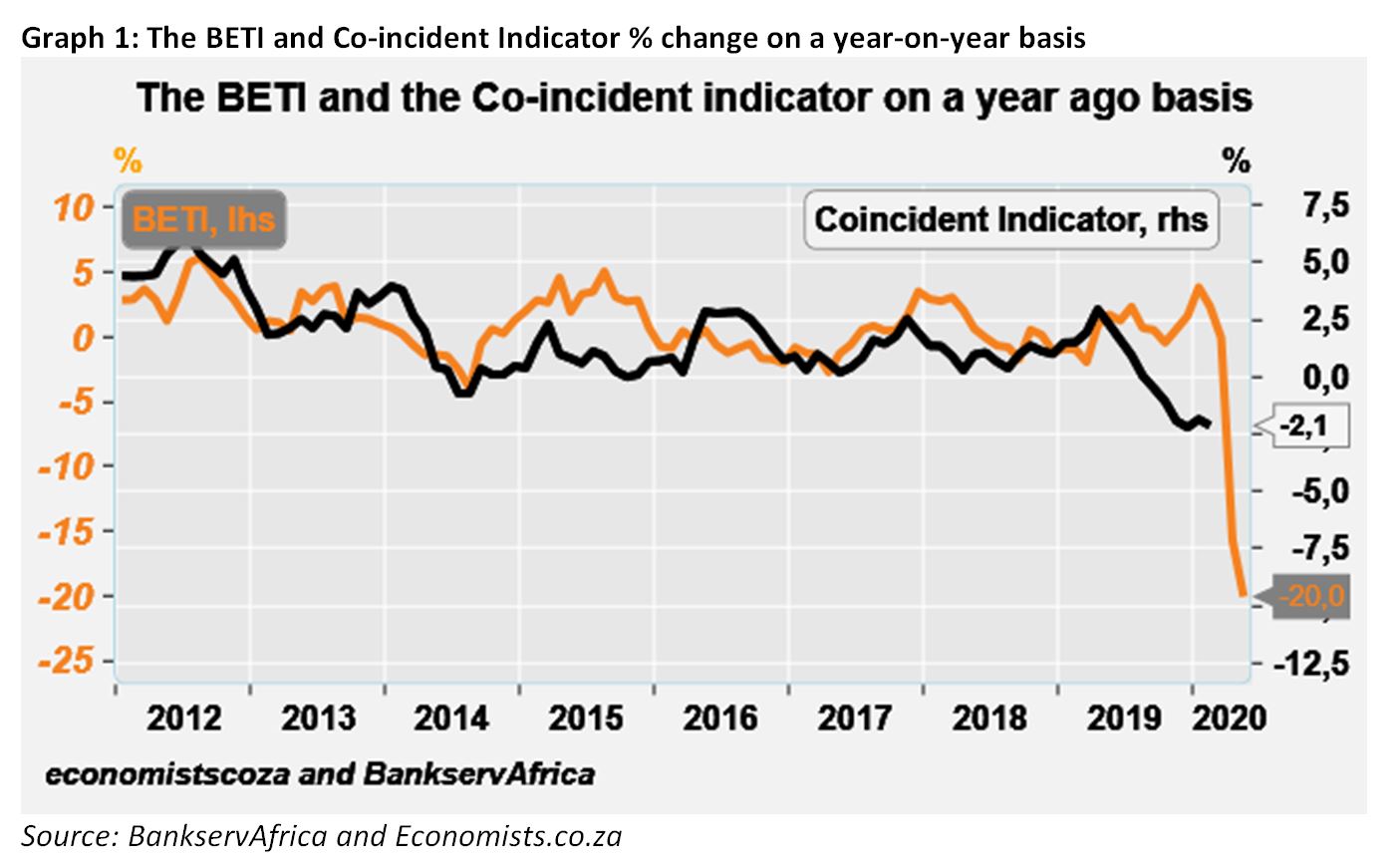

The BankservAfrica Economic Transaction Index (BETI) tracked a monthly improvement in May 2020, suggesting the worst of the economic impact from the COVID-19 lockdown levels is over. However, the overall impact over the three months to May points to a long road to recovery for the South African economy.

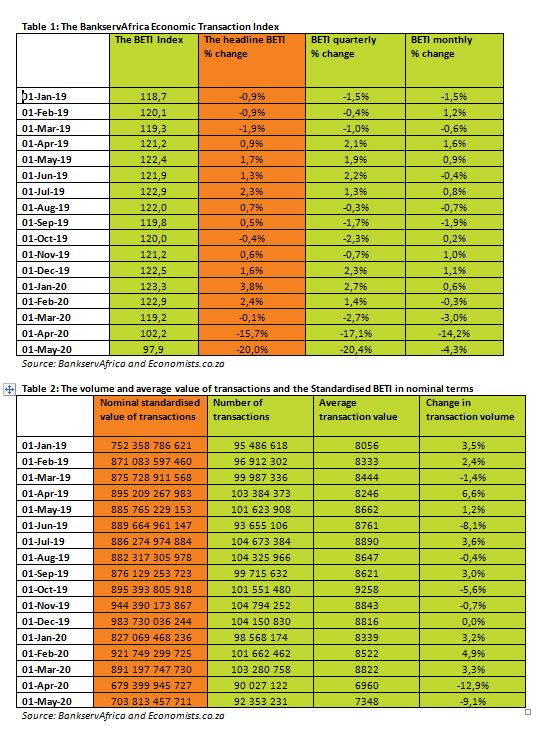

“The monthly BETI showed less of a decline of -4.3% in May compared to April’s -14.2%. While this movement offers some relief, the data over the three months ending May 2020 reflects the biggest fall on our records with the actual total value of transactions in real terms lower than any period since April 2005,” says Shergeran Naidoo, Head of Stakeholder Engagement: BankservAfrica.

“The BETI, which comprises of the value and number of transactions, saw both declining substantially in May 2020. Our data shows the economy recorded 20% less in transaction value than a year ago and that the number of transactions fell by 9.1% year-on-year,” says Naidoo.

He adds: “The total value of transactions fell due to the average value per transaction falling faster than the number of transactions. This has to do with the economic conditions surrounding COVID-19.”

Over March to May 2020, economic activity crashed by 20.4%. “The size and speed of this collapse in just three months can be likened to falling off a cliff,” says Mike Schüssler, Chief Economist at economists.co.za.

The South African Reserve Bank data showed a 10.4% increase in deposits by South African residents in April over the last year as many took on a more conservative approach to their finances. This is the highest increase since the Great Recession of 2008/9 and ties in with the collapse of economic activity. With all the uncertainty, people and businesses have reduced their spending considerably with more opting to invest in their savings.

The storage data for April showed 13% less goods in warehouses – although some energy storage sites are stocked up on fuel products, such as petrol and jet fuel, that are not selling. It is expected that mining and wholesale will also be affected with knock-on effects on their supply chains. Limited purchases on higher-priced items, such as vehicles, and property sales have also dented transaction levels.

“One thing that is positive is that the BETI decline for May is far lower than that which was experienced in April and is a hopeful sign that the worst is over,” says Schüssler. But he adds that owing to the period of the COVID-19 lockdown, a better reflection of the economy lies in the difference between the quarter to May compared to the quarter to February.

The BETI is the widest and fastest actual real economy indicator. Based on smoothed and raw data of South Africa’s electronic payments interbank transactions routed through BankservAfrica, the BETI’s annual comparison has a very close relationship with the Gross Domestic Product of the South African economy. The size of the BETI decline in the first two months of Q2 2020 suggests the economy remains under severe pressure.

“We believe that a bounce back, particularly in the third quarter, is highly likely off these lows, but one would need to monitor the strength and sustainability very closely. We remain hopeful that while lockdown level 3 may have a positive impact in June, at least a double-digit decline in GDP for the second quarter can still be expected,” says Schüssler.

“We could also see the emergence of a new normal functioning economy post-COVID-19 where technology is vital in the day-to-day management of businesses. Various scenarios could play out such as office space being used less as many work from home. There could be a stronger demand for services, such as elective medical procedures for treatments that were delayed during the crisis. Eating out or watching a sports game live could resume, albeit via potentially different channels and done differently to how it was done pre-COVID-19, as individuals return to their old ways of consuming, socialising and, ultimately, spending,” ends Naidoo.

Ends

Contact Leigh-Anne Sa Joe for more information: Leigh-AnneS@Bankservafrica.com or (011) 497 4347.

Notes to the Editor:

The BETI stands for the BankservAfrica Economic Transaction Index. BankservAfrica is a payment enabling organisation operating between the various South African banks with a very secure messaging environment in place. Economists.co.za is an economic consultancy that helped develop the BETI.

The BETI is a very fast and broad overview of current economic trends over a broad range of sectors, making use of economic transactions as captured by BankservAfrica. Like the Swift Index, the BETI is considered a “now-cast” number as a result of its speedy ability to convey the overall economic conditions to the market. Where most economic indicators can take anything between 38 and 76 days to become public knowledge, now-cast indicators take less than a month after the facts were revealed to come to the market.

The BETI is also the broadest of the “now-cast” indicators to come to the market, as it covers economic transactions across the whole economy. Very big distortive economic transactions do not form part of the BETI. This is also on its own a trend-strengthening indicative factor.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low value card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 47-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.

May 2020 BETI report to accompany press release

Date: 10 June 2020

Economic transactions show depth of the COVID-19 lockdown

Actual total real value of transactions shows biggest drop between March to May

The BankservAfrica Economic Transaction Index (BETI) for the three months ending May 2020 reflected the sharpest decline in its history. The economy recorded 20% less in transaction value than a year ago.

While the monthly BETI decline of -4.3% was not as substantial as April’s -14.2%, the March to May period represented the biggest drop on record with the actual total value of transactions lower than any period since April 2005 in real terms.

The size of the collapse in economic transactions that underlie economic activity is perhaps best reflected in the quarter-on-quarter comparison which crashed by 20.4%. The speed of the collapse of over 20% in just three months has been devastating.

The volume and value of transactions in May

The actual volume of transactions declined by 9.1% on a year-on-year basis in May. The average value per transaction declined by 15.2% in nominal terms. The number of transactions in May was at its lowest level on a three-month moving average basis since October 2017.

But, also significant, the average transaction value in nominal terms declined to the extent that May reflected the lowest average since January 2014. This, however, was an improvement from April – the worst month since January 2013.

The average value per transaction was the lowest on our records (which goes back to January 2002) in the last two months in real terms. This has to do with the economic conditions surrounding COVID-19.

What happened to the BETI in May

The South African Reserve Bank data showed a 10.4% increase in deposits of South African residents in April over the last year. This is the highest increase since the Great Recession of 2008/9 and ties with the collapse of economic activity. With a great deal of uncertainty, people and businesses have reduced their spending considerably with more opting to invest in their savings.

The storage data for April showed 13% less goods in warehouses – although some energy storage sites stocked up on fuel products, such as petrol and jet fuel, that are not selling. It is expected that mining and wholesale will also be affected with knock-on effects on their supply chains. Limited purchases for higher-priced items, such as vehicles, as well as property sales have also dented transaction levels.

On the whole, the BETI decline in May showed a decline that is far lower than that experienced in April. This is certainly a hopeful sign that the worst is over. But a better reflection of the total economy lies in the difference between the quarter to May compared to the quarter to February. We need to note that the quarterly and annual data will for some time reflect declines as the size of the decline has been substantial.

What this could mean for our GDP and economy as a whole

The BETI is the widest and fastest actual real economy indicator. Based on smoothed and raw data of South Africa’s electronic payments interbank transactions routed through BankservAfrica, the BETI’s annual comparison, has a very close relationship with Gross Domestic Product (GDP) of the South African economy. The size of the BETI decline in the first two months of Q2 2020 suggests the economy remains under severe pressure.

A bounce back is highly likely off these lows, but one would need to monitor the strength and sustainability very closely. While we remain hopeful that lockdown level 3 may have a positive impact in June, a double-digit decline in GDP for the second quarter can still be expected.

We could also see the emergence of a new normal functioning economy post-COVID-19 where technology is vital in the day-to-day management of businesses. Various scenarios could play out such as office space being used less as many work from home. There could be a stronger demand for services, such as elective medical procedures for treatments that were delayed during the crisis. Eating out or watching a sports game live could resume, albeit via potentially different channels and done differently to how it was done pre-COVID-19, as individuals return to their old ways of consuming, socialising and, ultimately, spending.