Press release: For immediate release

Date: 14 October 2020

The ‘swoosh’ economic recovery continues

The South African economy remains on course to a ‘swoosh’ recovery, according to very latest data from the BankservAfrica Economic Transactions Index (BETI), which also indicates stronger growth for South Africa’s upcoming Q3 2020 gross domestic product (GDP) figures.

“The BETI for September 2020 showed a monthly change of 2.7%. Although this was a fourth consecutive month of growth, the rate has slowed down by 1.8% in August 2020 and 6.5% in July 2020 – reflecting the typical nature of a swoosh recovery from the COVID-19 lockdown economy of a quick regain then a gradual slowdown,” says Shergeran Naidoo, Head of Stakeholder Engagement: BankservAfrica.

On an annualised basis, the BETI was marginally higher for the first time in six months with an unexpected improvement of 0.4%. “This is the first since March 2020 and a significant shift from -4.3% in August 2020,” says Naidoo.

However, these increases come off the back of the weaker months in September 2019 and October 2019.

“Therefore, the monthly data changes better reflect the state of the economy at present. Four months of declines, of which April’s -13.9% dip was by far the deepest, followed by four months of increases of which July was the strongest followed by successive months of gradually slowing increases in the South African economy – with September being the slowest increase,” says Mike Schüssler, Chief Economist at economists.co.za. “This reflects the archetypal ‘swoosh’ recovery.”

According to Naidoo, the nominal standardised transaction value was R930.6 billion in September 2020. This was the highest in 2020 but below the values in November 2019 and December 2019. The number of transactions in September was 102.9 million, which was less than July 2020 but higher than most months in 2020.

“The economy’s bounce back could be due to reasons such as the move to lockdown level 1 in September. This was met with relief by businesses and consumers alike. The government’s relief funds, in the form of UIF-TERS benefit payments, special COVID-19 Social Relief Distress (SRD) grant and other institutional pay-outs, amounted to over R100 billion since May 2020 and certainly helped to keep consumer spending and economic activity afloat,” says Schüssler.

Although the lower interest rates will be around for some time, the possible decline in COVID-19 UIF-TERS will have an impact, as well as the possible discontinuation of the SRD grant payment, which is expected to end in October 2020. South Africa’s leading economic indicators will probably show a better reflection of the post-COVID-19 reality in the coming months. “The debt burden and declines in extra grant payments may see a slower recovery from November onwards,” says Schüssler.

The BETI provides South Africa with a fast indication of underlying economic trends across the economy and is generally in sync with the broader GDP changes in the country. With the latest BETI data, the GDP growth for Q3 2020 is likely to be the fastest on record – or at least since 1946. The seasonally adjusted and annualised growth is expected to be around 40% to 50%.

“Although the rate of growth for September’s BETI was slower than that in June 2020, the monthly growth is still moving in an upward direction that many hope the economy will continue going on. This is far from the plummeting declines experienced in the initial months of COVID-19 lockdown,” ends Schüssler.

Ends

Contact Leigh-Anne Sa Joe for more information: Leigh-AnneS@Bankservafrica.com or (011) 497 4347.

Notes to the Editor:

The BETI stands for the BankservAfrica Economic Transaction Index. BankservAfrica is a payment enabling organisation operating between the various South African banks with a very secure messaging environment in place. Economists.co.za is an economic consultancy that helped develop the BETI.

The BETI is a very fast and broad overview of current economic trends over a broad range of sectors, making use of economic transactions as captured by BankservAfrica. Like the Swift Index, the BETI is considered a “now-cast” number as a result of its speedy ability to convey the overall economic conditions to the market. Where most economic indicators can take anything between 38 and 76 days to become public knowledge, now-cast indicators take less than a month after the facts were revealed to come to the market.

The BETI is also the broadest of the “now-cast” indicators to come to the market, as it covers economic transactions across the whole economy. Very big distortive economic transactions do not form part of the BETI. This is also on its own a trend-strengthening indicative factor.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low value card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 48-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.

September 2020 BETI report to accompany press release

Date: 14 October 2020

September 2020 BETI: The ‘swoosh’ recovery continues

SA’s Q3 2020 GDP growth likely to be the highest on record

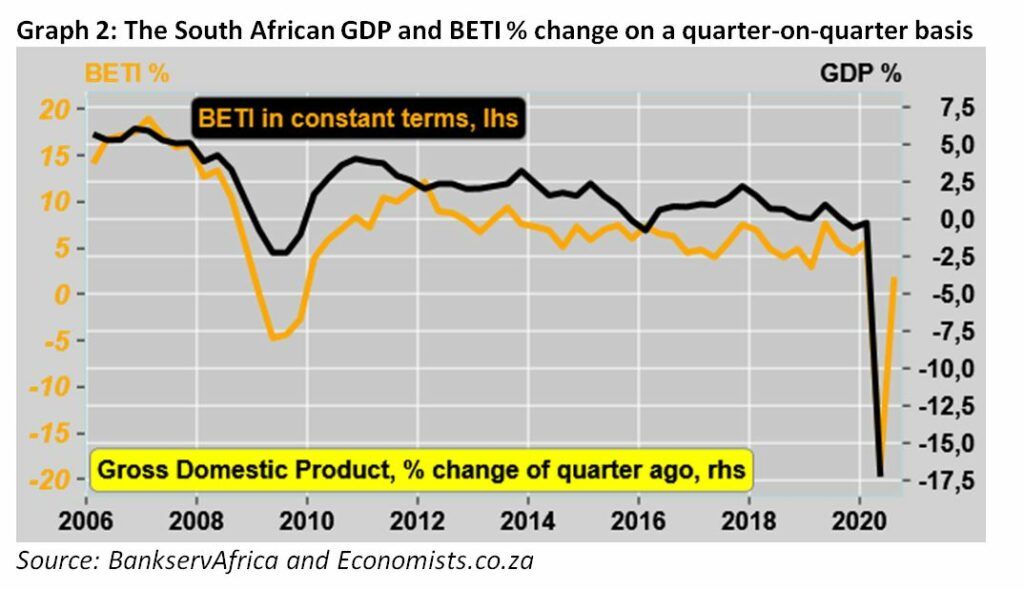

The BankservAfrica Economic Transactions Index (BETI) improved for the fourth consecutive month in September 2020 and indicates South Africa’s approaching third-quarter gross domestic product (GDP) figure will be the strongest on record.

The headline BETI, which tracks economic transactions on an annualised basis, was marginally higher for the first time in six months. The unexpected improvement of 0.4% – the first since March 2020 and a significant shift from -4.3% in August 2020 – is welcomed news.

However, one must take into consideration that September 2019 and October 2019 were weak months, recording the lowest turnover in the economy for the last nine months of 2019. Therefore, although all periods over which we measure the BETI for were positive, the fact is that the economy is not nearly at the level it reached in January 2020 or July 2019.

Perhaps the monthly data changes are a better reflection of the state of the economy at present. Four months of declines, of which April’s -13.9% dip was by far the deepest, followed by four months of increases of which July was the strongest then followed by three successive months of gradually slowing increases in the South African economy, with September being the slowest increase – an archetypal ‘swoosh’ recovery.

There is no doubt that the economy has had a bounce that could be due to the move to lockdown level 1 in September 2020, which brought some relief to businesses and consumers. In addition, the government’s relief funds helped to avert an even bigger socio-economic disaster. Most of the spending, in the form of COVID-19 UIF-TERS benefit payments, COVID-19 Social Relief of Distress (SRD) payments and other institutional pay-outs, which in total amounted to over R100 billion since May 2020, helped to keep consumer spending and economic activity afloat.

Moreover, while the lower interest rates will be around for a lengthier time, the decline in COVID-19 UIF-TERS payments will have an impact, as well as the possible discontinuation of the special COVID-19 Social Relief of Distress grant, which is expected to end in October 2020. South Africa’s leading economic indicators will probably show a better reflection of the post-COVID-19 reality in the coming months.

So, while recovery is slowing as expected, the improvement has been quicker than one would have dared to hope for. However, the debt burden and possible declines in extra grant payments may result in a slower recovery from November 2020 and onwards.

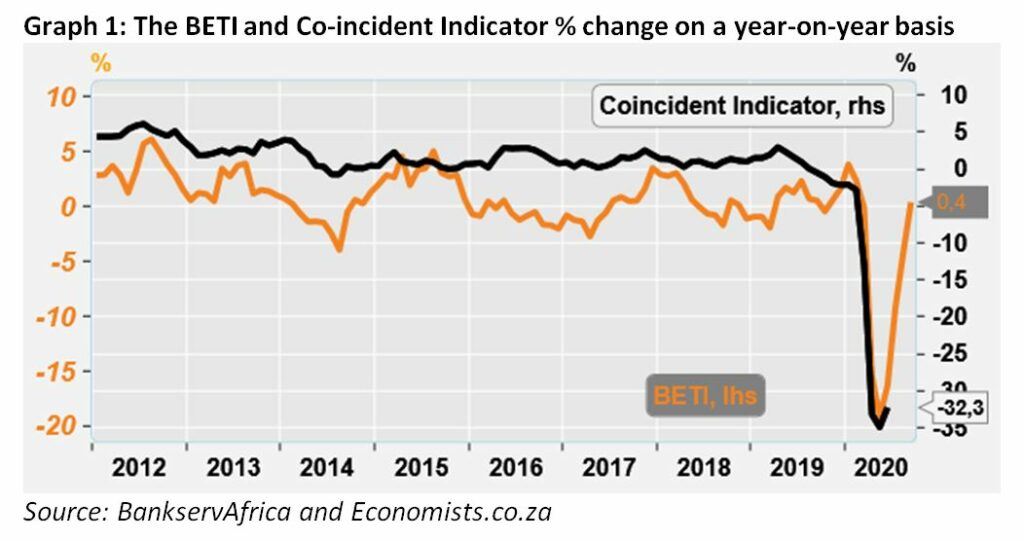

The BETI provides South Africa with a fast indication of underlying economic trends across the economy and is generally in sync with the broader GDP changes in the country. With the latest data, we are convinced that the GDP growth for Q3 2020 is likely to be the fastest on record – or at least since 1946. We expect that the seasonally adjusted and annualised growth to be around 40% to 50%.

We still contend that the closer the economy gets to its previous level, the smaller the growth rate becomes as capacity problems, such as electricity constraints, resurface. The SA economy’s full recovery is likely to show in 2022 or thereafter. As stated in the BETI for August 2020, ‘the swoosh recovery, like the Nike logo, is a recovery that is quick at first (in Q3 2020) and slower later (during 2021)’.

Although the rate of growth for the BETI was slower in September 2020 than in June 2020, there is an appreciation of the monthly growth, which was still in an upward direction – and far from the plummeting declines experienced in the initial months of the COVID-19 lockdown.

The standardised transaction values

The nominal standardised transaction value was R930.6 billion, which was the highest for 2020 but below November and December 2019’s values. The number of transactions was 102.9 million, which was less than the July 2020 number of transactions yet higher than most months of 2020.

Graph 2: The South African GDP and BETI % change on a quarter-on-quarter basis

Source: BankservAfrica and Economists.co.za