Press release: For immediate release

Date: 12 August 2020

The BETI’s strong run continues into July 2020

Economic activity continued performing on stronger levels in July 2020, according to the latest monthly data from BankservAfrica’s Economic Transaction Index (BETI). This second month of recovery comes on the back of special relief funds and payment holidays that have provided the much needed boost to the economy, which has since recovered 56% of what was lost in January 2020.

“Our recent monthly data is a positive showing of the impact of the gradual easing of the lockdown restrictions on the South African economy. However, the tough times remain – even while transactions were up, they were still 9% lower than the previous year. We also need to be mindful that these came off a very low base as South Africa entered a technical recession pre-COVID-19,” says Shergeran Naidoo, Head of Stakeholder Engagement: BankservAfrica.

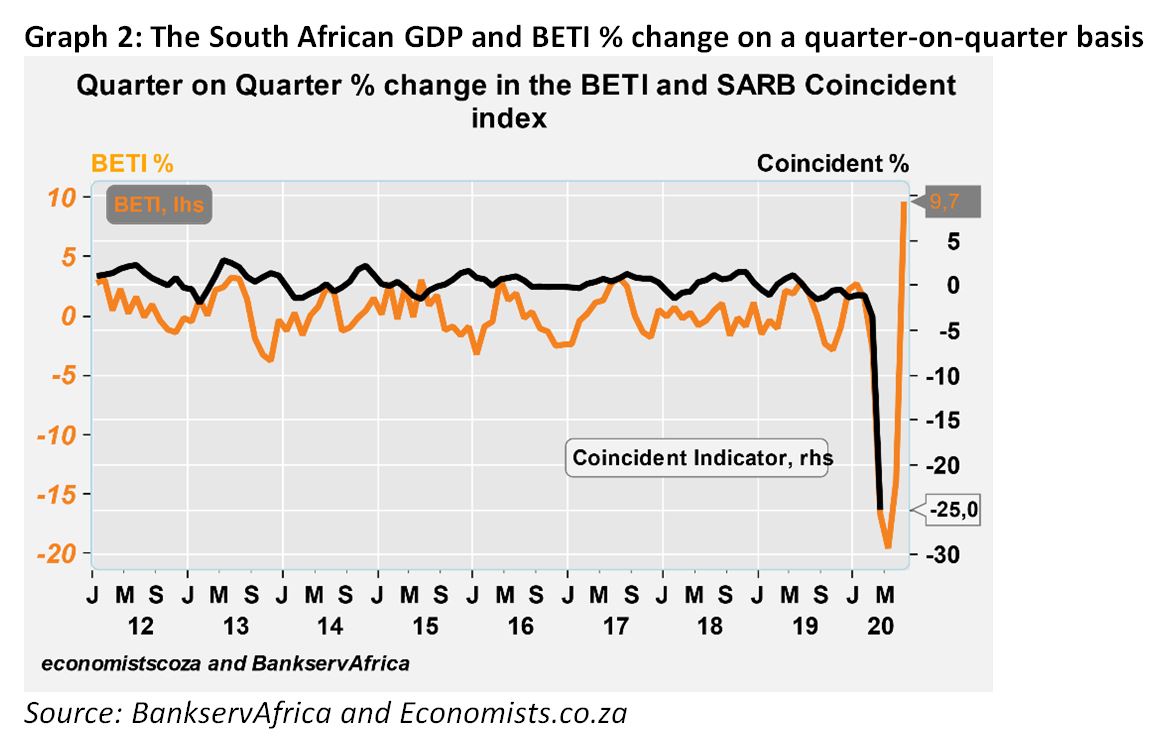

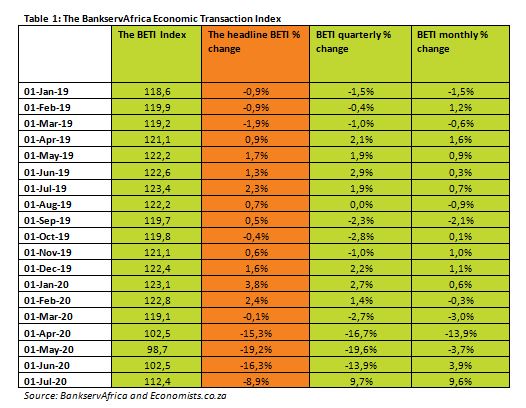

The BETI for July 2020 was 112.4 and showed a 9.6% monthly change from June. “July represents the best monthly change on the BETI’s records,” says Naidoo. Also notable was the 9.7% quarterly change to July 2020 compared to the quarter to April 2020.

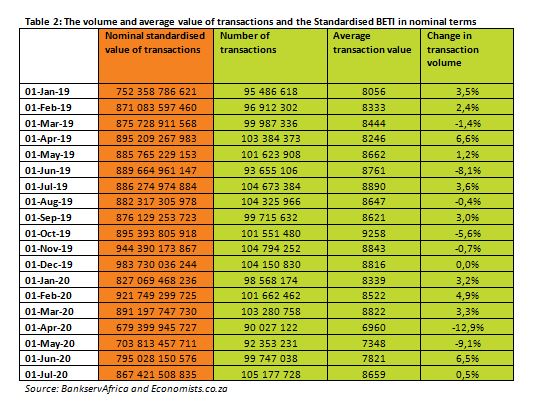

The overall standardised economic transactions in July was R867.4 billion – R188 billion more in nominal terms than the value in April. A rough estimate of the amount of money made available to the South African economy to combat the economic slowdown and disease would suggest that at least 12% of the improvement (the R188 billion) comes from the extra spending by the South African Government.

“The monthly and quarterly increases for the BETI show the economy bouncing back from the terrible blows in April and May 2020,” says Mike Schüssler, Chief Economist at economists.co.za. “The COVID-19 lockdown has been harsh on the South African economy with the economic activity in April 2020 reaching its lowest in 15 years. However, the gradual easing of restrictions along with lockdown measures have provided a massive stimulus to the economy.”

An additional R20 billion per month was made available to the economy through the UIF COVID-19 Temporary Employee Relief Scheme (TERS) pay-outs to the value of about R12 billion between the end of April and early August, and SASSA payments of about R8 billion a month at the beginning of August over and above the normal grant payments. These made transactions on the retail side possible. Consumers and businesses also had more room to spend through other funds such as the Solidarity Fund, loan and rent holidays. As such, some transactions that were not made in April were done in the June or July months.

“These have helped provide short-term stability to the economy,” says Schüssler. “The strong BETI transaction data, which is processed by BankservAfrica through the National Payments System, suggests the extra payments gave a boost for consumer purchases of goods and services, which then passed on to businesses to order more products and provide more services to meet the demand. The advanced lockdown level 3 involving the re-opening of restaurants, personal care services, casinos, motor car sales at dealerships and increased sales at general stores, amongst others, combined with the short period of alcohol sales, also helped. The good news is that economy has recovered 56.2% of what it has lost since January.”

But there is still long road ahead for the South African economy. “Despite these improvements, the real value of economic transactions is 9% below the levels seen in July 2019,” says Naidoo. The decline of 19.2% during the heavy lockdown period to May is the deepest quarterly decline on record in the BETI’s history, and comes as a result of the lockdown.”

“While the extra spending and low interest rates have helped the economy to bounce back, the economy remains weak. There’s also the risk that this recovery will be severely disrupted – or slowed down – with the UIF TERS funding diminishing and the extra SASSA payments ending in October,” says Schüssler.

“Still, the July BETI was as good as it could be expected. But the next three months will be critical for the sustained recovery of the South African economy. We could see a flatter movement, especially when considering the downturn in manufacturing output, the limitations on airfreight and its direct impact on the distribution and the sale of goods. In addition to these, the tourism sector, a major contributor to South Africa’s economic growth, remains closed to domestic and international travellers due to COVID-19, and will surely affect the overall numbers,” he ends.

Ends

Contact Leigh-Anne Sa Joe for more information: Leigh-AnneS@Bankservafrica.com or (011) 497 4347.

Notes to the Editor:

The BETI stands for the BankservAfrica Economic Transaction Index. BankservAfrica is a payment enabling organisation operating between the various South African banks with a very secure messaging environment in place. Economists.co.za is an economic consultancy that helped develop the BETI.

The BETI is a very fast and broad overview of current economic trends over a broad range of sectors, making use of economic transactions as captured by BankservAfrica. Like the Swift Index, the BETI is considered a “now-cast” number as a result of its speedy ability to convey the overall economic conditions to the market. Where most economic indicators can take anything between 38 and 76 days to become public knowledge, now-cast indicators take less than a month after the facts were revealed to come to the market.

The BETI is also the broadest of the “now-cast” indicators to come to the market, as it covers economic transactions across the whole economy. Very big distortive economic transactions do not form part of the BETI. This is also on its own a trend-strengthening indicative factor.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low value card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 48-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.

July 2020 BETI report to accompany press release

Date: 12 August 2020

Strong recovery for the BETI continues into July 2020

But economic transactions were still 9% down year-on-year

The BankservAfrica Economic Transaction Index (BETI) recorded an increase of 9.6% between June and July 2020. The quarter to July 2020 compared to the quarter to April 2020 reflected a 9.7% increase, also the strongest movement since the start of the BETI record keeping.

The monthly and quarterly increases are clearly the result of parts of the economy bouncing back from the terrible blows in April and May 2020. The COVID-19 lockdown has been harsh on the overall South African economy. However, the gradual easing of restrictions and re-opening of the economy have brought positive movements.

The very fact that the level of economic activity in April was the lowest in 15 years, as seen in our data, has meant that there was likely to be an improvement as South Africa slowly released some of the lockdown measures and provided a massive stimulus to the economy.

An additional R20 billion per month was made available to the economy through the UIF COVID-19 Temporary Employee Relief Scheme (TERS) pay-outs to the value of about R12 billion between the end of April and early August, and SASSA payments of about R8 billion a month at the beginning of August over and above the normal grant payments. These made transactions on the retail side possible. Consumers and businesses also had more room to spend through other funds such as the Solidarity Fund, loan and rent holidays. As such, some transactions that were not made in April were done in the June or July months.

All of the above helped to stabilise the economy in the short-term. The turnaround and catch-up have really helped to lift the economy off the ground. Never has so much been spent from government and business relief funds.

As can be seen in the transactions processed by BankservAfrica through the National Payments System, the extra payments facilitated consumer purchases for goods and services, giving businesses more reason to order more products and provide more services. These, together with the advanced lockdown level 3 that involved the re-opening of restaurants, personal care services, casinos, motor car sales at dealerships and general stores, amongst others and combined with the short period of alcohol sales, have helped the economy. The good news is that the economy has recovered 56.2% of what it lost since January.

The overall standardised economic transactions for July was R867.4 billion – R188 billion more in nominal terms than in April. A rough estimate of the amount of money made available in the South African economy to combat the economic slowdown and disease would suggest that at least 12% of the improvement (the R188 billion) comes from the extra spending by the South African Government. This suggests that most of the improvement is sustainable. However, there will be a high risk of some smaller declines in the economy going forward.

The next three months will be critical for the SA economy

The South African economy is not out of the woods yet. The real value of economic transactions is still 9% below July 2019’s levels. To put this into context, the decline of 19.2% during the heavy lockdown period to May is the deepest quarterly decline on record in the BETI’s history, and comes as a result of the lockdown.

So, while the economy has bounced back strongly – partly on the back of the extra spending and low interest rates – the fact is the economy is still very weak as these improvements have come off a very low base from South Africa’s technical recession before COVID-19. The UIF TERS funding is slowly diminishing while the extra SASSA payments will end in October. These can disrupt the economy’s recovery – or slow it down.

The July BETI was as good as it could be expected. The next three months will be critical for the sustained recovery of the South African economy. We could see a flatter movement in the coming months, especially when considering the downturn in manufacturing output, the limitations on airfreight and its direct impact on the distribution and the sale of goods. In addition to these, the tourism sector, a major contributor to South Africa’s economic growth, remains closed to domestic and international travellers due to COVID-19, and will surely affect the overall numbers.