Press release: For immediate release

Date: 23 February 2021

Salaries shrunk in January 2021

Average banked private pensions reached highest level on record

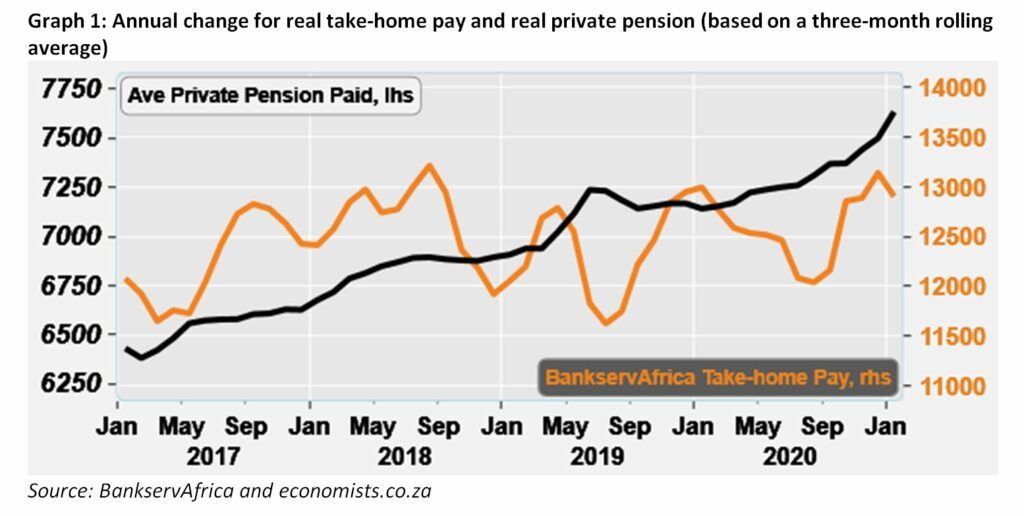

The real average and overall salary paid contracted in January 2021 after coming under strain from the pandemic and level 3 lockdown, according to the latest BankservAfrica Take-home Pay Index (BTPI). However, South Africa’s real private pensions reached the best level on record in the BankservAfrica Private Pension Index (BPPI).

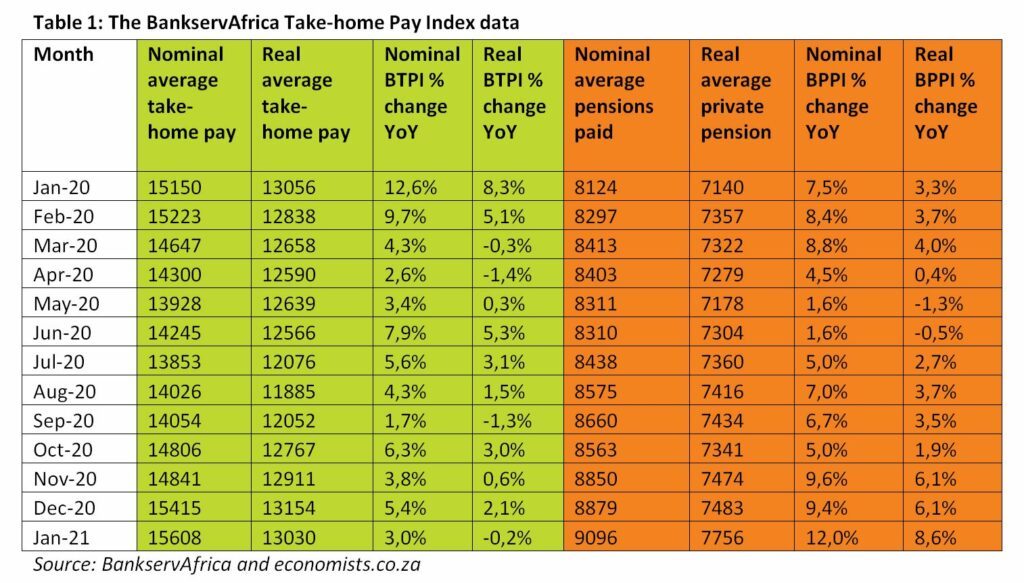

“The real average salary was R13 030, which represents a -2.4% decline from December 2020 and a -0.2% year-on-year decrease,” says Shergeran Naidoo, BankservAfrica’s Head of Stakeholder Engagements. “This is a sure sign of the pressure that average salaries faced under this period.”

This, however, reflects a return to the usual movements as average salaries in the BTPI typically decline before making a slight comeback in real terms. It could also have to do with the high average salary base from the previous year.

“Still, we can’t ignore the current environment’s influence. As South Africa and the world begins to emerge from the lockdown and pandemic, and vaccinations slowly come to the rescue, one can expect a return of negative months before things hopefully improve,” says Mike Schüssler, Chief Economist at economists.co.za.

Inflation also played a role in the BTPI. In January 2021, the total take-home pay paid into the combined bank accounts of employees was up by just 0.6% before inflation. However, when taking inflation over the past year into consideration, this declined by -2.5%.

“The economic bounce back has been impressive and most formal sector employees paid via the National Payment System have managed to keep their jobs or were re-employed,” explains Schüssler.

However, one should not get optimistic too soon as the total number of banked take-home pay remains lower than a year ago and before the pandemic. “A number of people are still not back at work, which we believe to be the reason for the -3.2% decline in the monthly equivalent paid between January 2020 and 2021,” says Schüssler.

According to the BTPI, the average salary figures are beginning to normalise, as has been expected a few months back. This return to normal for salaries should continue with a few affected industries expected to experience some shocks in the coming months.

The overall take-home numbers suggest January will be a weak consumer spending month when compared to a year ago. However, the reinstatement of the COVID-TERS payments until the end of March for industries affected by the lockdown may provide some relief in the short term.

But, with the average real take-home pay declining, it will be interesting to see if there will be tax relief for employed South Africans when the National Budget Speech is tabled tomorrow. This is as businesses and households come under even more financial pressure from the planned 16% hike in electricity costs in April.

Private pensions shot up

The total amount paid for all private pensions and the average private pension increased well above the rate of inflation.

“The BankservAfrica Private Pension Index (BPPI) increased by 8.6% year-on-year and in real terms. This is by far also the highest real increase of BPPI we have on record,” says Naidoo.

However, this should be considered against the -4.5% decline in the number of payments made to private pensioners. The fall in numbers was from pensioners receiving less than R12 000 in the bank. Those receiving between R6 000 and R12 000 declined by -3.2%. The number of private pensioners receiving between R2 000 and R6 000 fell by -8.2%. Those banking less than R2000 fell by -10%.

“This probably has to do with rule changes in the pension regulations which makes provision for pensioners with less than R247 000 to withdraw remaining money in their retirement fund. Provident funds and retirement annuities now share the same set of regulations,” explains Schüssler.

As such, pensioners may have combined their provident fund and retirement annuity. This may explain the double digit increase in the number of pensioners receiving over R12 000 in the bank. The number increased by 11.1% from January 2020.

Despite this, the overall total pensions paid increased by 2.2% year-on-year, after inflation. Combined with the overall decline in the number of pensioners, this led to the highest average real private pension increase ever experienced via the BankservAfrica payments system.

Ends

Contact Leigh-Anne Sa Joe for more information: Leigh-AnneS@bankservafrica.com or (011) 497 4347.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low values card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 48-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.

Report: To accompany the press release

Date: 23 February 2021

Average pensions shot up as take-home pay shrunk in January

The real average and overall compensation paid shrunk in real terms. The pandemic and level 3 lockdown had an impact on wages, as the BankservAfrica Take-home Pay Index (BTPI) data for January 2021 shows. However, the average banked private pension reached record levels.

South Africa’s take-home pay declined by 0.2% year-on-year in January 2021, indicating average salaries remained under pressure during this period.

In a sense, this is a return to normal as average salaries in our take-home index have often declined slightly then displayed a mild comeback in real terms. The high average salary base of the year before – on the back of the changed methodology (see the ‘note to the editor’ below) – played a role.

However, as South Africa and the world finally begins to emerge from the lockdown and pandemic, and vaccinations slowly come to the rescue, one can expect the return of negative months.

Another important indicator that comes from the BTPI is the total take-home pay paid to all the people in the system. In January 2021, the total take-home pay paid into the combined bank accounts of employees was up by just 0.6% before inflation.

When taking inflation over the past year into account, the result is a -2.5% decline. This shows that the economic bounce back has been impressive and that most formal sector employees paid via the National Payment System have managed to keep their jobs or were re-employed.

But there is still a weakness. The total number of take-home pay banked is still lower than a year ago before the pandemic. A number of people are not back at work which we believe to be the reason for the -3.2% decline in the monthly equivalent between January 2020 and 2021.

The overall take-home numbers suggest January will be a weak consumer spending month when compared to a year ago. The reinstatement of the COVID-19 TERS payments until the end of March for industries affected by the lockdown may provide some relief in the short term.

In recent months the BTPI has documented the declining salary numbers as a result of the lockdown’s impact on the economy and businesses. It will be interesting to see if there will be tax relief for employed South Africans when the National Budget Speech is tabled tomorrow afternoon. This is as businesses and households face the additional pressure of the 16% hike in electricity costs in April.

BankservAfrica private pension data is the exact opposite of the take-home pay

The total amount paid for all private pensions and the average private pension increased well above the rate of inflation.

The BankservAfrica Private Pension Index (BPPI) increased by 8.6% year-on-year and in real terms. This is by far the highest real increase in the BPPI on record.

This, however, may not be the full picture as the number of private pensioners declined by -4.5%. This was for pensioners receiving less than R12 000 in the bank. Those who banked less than R2000 reflected substantial declines as the pension numbers fell by -10%.

The number of private pensioners receiving between R2 000 and R6 000 fell by -8.2%. The number of pensioners paid between R6 000 and R12 000 declined by just -3.2%.

This probably has to do with rule changes in the pension regulations which makes provision for pensioners with less than R247 000 to withdraw all the remaining money in their retirement fund. Provident funds and retirement annuities now share the same set of regulations.

As such, pensioners may have combined their provident fund and retirement annuity. This may explain the double digit increase in the number of pensioners receiving over R12 000 in the bank. The numbers increased by 11.1% from January 2020. This explains the drastic changes in these categories.

The overall total pensions paid rose by 2.2% year-on-year, after taking inflation into account. This, combined with the overall decline in the number of pensioners, resulted in the highest average real private pension increase ever experienced via BankservAfrica.

Note to the editor about the BTPI

There have been revisions to the BTPI due to a change in the South African National Payment System (NPS), which now excludes all salary payments from other Southern African Customs Union member countries in the Common Monetary Area (CMA). This occurred for the period from June 2018 onwards. Under the request by the South African Reserve Bank, the CMA payments were removed, and, as such, this needed to adjusted accordingly in the BTPI data set. This means the historical data that included these countries were removed and adjusted. This took place over more than a month. We have therefore undertaken a review of the massive decline in average wages in July 2019 – August 2019. Please also note that due to this, the September 2018 – September 2019 data has been revised and has resulted in minor changes to the 2019 data.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low value card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 48-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.