Press release: For immediate release

Date: 9 December 2020

The BETI falls flat in November 2020

The BankservAfrica Economic Transactions Index (BETI) fell flat in November 2020, suggesting lower economic growth for Q4 2020, which may lead to reduced spending over the December holiday break.

“The BETI was 121.8 in November 2020, which represents a 0.1% monthly decline. This is the first in six months following the strong rebound that carried the economy forward,” says Shergeran Naidoo, BankservAfrica’s Head of Stakeholder Engagements. “But, as we can see in the latest data, this is slowing down. Businesses and consumers are holding back on their spending to the extent that Black Friday 2020 – or ‘Black November’ – failed to deliver for the South African economy.”

The economic slowdown is becoming more distinct in the year-on-year numbers. The BETI slowed down by 0.8% in November unlike October’s strong monthly improvement of 1.9%.

“The number of transactions in the BETI framework decreased by 2.1% year-on-year to reach 102.6 billion for November. The value, in nominal terms, was R97.6 billion, which was 2.8% higher year-on-year,” says Naidoo.

The BETI data also showed the volume of debit transactions declined by 10.7% year-on-year while Real-Time Clearing (RTC) improved by 62.4%. It seems the shift towards RTC payments, and the increase in other ‘push’ payments is being accompanied by a decline in the ‘pull’ side of transactions. This is further confirmed by the EFT credit increase of 8.2% in volume. “The decline, at least for the short-term, could be due to debit orders being cancelled or consumers failing to honour these, which is likely a result of the harsh economic climate,” explains Naidoo.

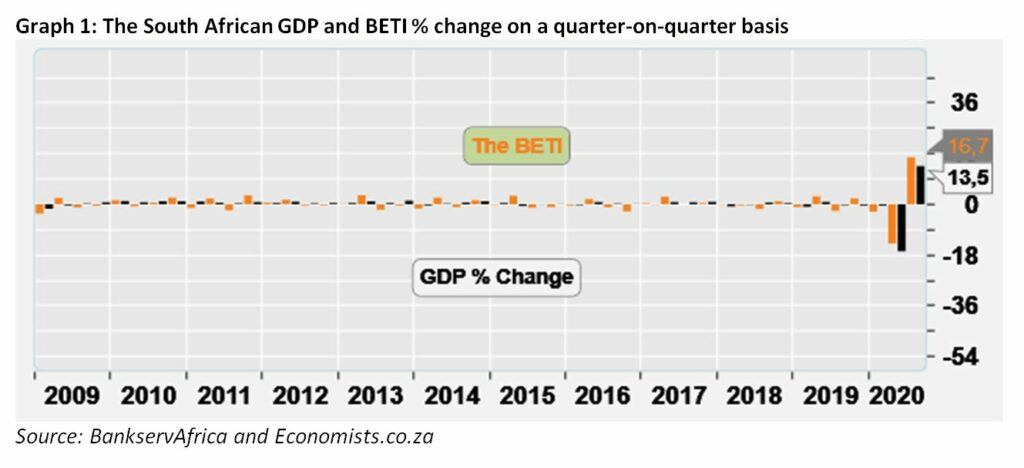

The overall BETI is still positive which indicates that the economy – although weaker overall – will still show growth in the last quarter of 2020. “But we will not see the record-breaking pace of GDP growth as we did in Stats SA’s Q3 2020 GDP growth figures of 66.1% on a seasonally adjusted and annualised basis, which the BETI also predicted. The past two months point to a slower growth trend following the economy’s re-opening,” says Mike Schüssler, Chief Economist at Economists.co.za.

With the extra spending via the COVID-19 UIF TERS payments ending in November and the increased SASSA grants closing in January 2021, some of the momentum for economic recovery will be lost. Moreover, as government spending will now ‘normalise’ in other areas too, the real damage to some of the underlying economy is likely to present itself.

“Many of the economic role players remain cautious in their spending owing to reduced earnings that has also resulted in salary cuts for their employees. This is just a pause but may carry over a few months and into the festive season,” says Schüssler.

The reduced foreign and local tourist spending, which is important for accommodation, travel, vehicle rentals and restaurants, combined with the cancellation of events such as concert, festivals and sports matches, others, will likely see much of the economy feel the real impact of COVID-19 and the lockdowns.

“These sectors typically offer offer extra employment and income and are much more important than usual over the country’s holiday season,” says Schüssler. “But the lowered spending and activity may see the December break play out very differently to the previous years.”

Ends

Contact Leigh-Anne Sa Joe for more information: Leigh-AnneS@Bankservafrica.com or (011) 497 4347.

Notes to the Editor:

The BETI stands for the BankservAfrica Economic Transaction Index. BankservAfrica is a payment enabling organisation operating between the various South African banks with a very secure messaging environment in place. Economists.co.za is an economic consultancy that helped develop the BETI.

The BETI is a very fast and broad overview of current economic trends over a broad range of sectors, making use of economic transactions as captured by BankservAfrica. Like the Swift Index, the BETI is considered a “now-cast” number as a result of its speedy ability to convey the overall economic conditions to the market. Where most economic indicators can take anything between 38 and 76 days to become public knowledge, now-cast indicators take less than a month after the facts were revealed to come to the market.

The BETI is also the broadest of the “now-cast” indicators to come to the market, as it covers economic transactions across the whole economy. Very big distortive economic transactions do not form part of the BETI. This is also on its own a trend-strengthening indicative factor.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low value card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 48-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.

November 2020 BETI report to accompany press release

Date: 09 December 2020

November stalls – possibly let down by a disappointing Black Friday

Q4 2020 data suggests a quieter holiday season for South Africa

Black Friday 2020 – or in this year’s terms ‘Black November’ (as the shopping promotions continued throughout November and over the Black Friday weekend to prevent in-store crowding) – failed to deliver for the South African economy. The BankservAfrica Economic Transactions Index (BETI) shows a flat economic performance for November 2020.

The record-setting pace of GDP growth in the third quarter of 66.1% on a seasonalised and annualised basis, as revealed by Stats SA yesterday, and predicted by the BETI, will not be as strong in Q4 2020. Although there is still one month left of this quarter, the past two months have reflected a slower growth trend after the economy’s re-opening.

The November BETI grew by 0.8% in November from November 2019. In comparison, the October 2020 number, measured on the same basis, was 1.9% up (adjusted downwards due to the higher than expected CPI and PPI data for October 2020). Nonetheless, the BETI is still positive which indicates that the economy – although weaker overall – will still show positive growth in the last quarter of 2020.

The monthly decline of just 0.1% between October and November is the first one in six months as the strong rebound in the economic momentum carried the economy forward. However, with the extra spending via the COVID-19 UIF TERS payments ending in November and the increased SASSA grants closing in January 2021, some of this momentum will be lost. Moreover, as government spending will now ‘normalise’ in other areas too, the real damage to some of the underlying economy is likely to present itself.

Although most of the lost ground has been made up by the economic recovery, many role players are wary of spending due to the current reduced payments from their employers or from their clients. This is just a pause, but it might carry over a few months and into the festive season.

Adding to this is the loss of local and foreign tourists spending, which is important for accommodation, travel, vehicle rentals and restaurants. In the fourth quarter, these sectors typically offer extra employment and income and are much more important than usual over the country’s holiday season. But, combined with the cancellation of events such as concerts and festivals, and sports having no spectators, among others, it is clear that much of the country will feel the real impact of COVID-19 and the lockdowns during this time.

Holiday destinations are likely to lower spending because of this, as will many other businesses and consumers who have experienced their economic woes from reduced earnings, salary cuts and enforced holidays. These will see reduced activity and spend that could result in the December break being very different from the previous years.

While not in our data per se, we have heard anecdotally that some factories are closing for longer periods due to few orders or supply chains disruptions. This has given them time to open more inventory later in the new year, but could have an impact on the employment, wages and the economy as a whole.

The standardised BETI up less than inflation while transactions numbers decrease

The standardised BETI in nominal terms reached R97.6 billion, which was 2.8% higher than November 2019. The number of transactions in the BETI framework was 102.6 billion for November, decreasing by 2.1% on a year-on-year basis.

Interestingly, the volume of all debit transactions declined by 10.7% over the last year while Real-Time Clearing (RTC) increased by 62.4%! It seems the shift towards RTC payments, and the increase in other ‘push’ payments is being accompanied by a decline in the ‘pull’ side of transactions. This is further confirmed by EFT credit increasing by 8.2% in volume. At least for the short-term, the commitment side of transactions in the form of contractual payments may be declining as debit orders are cancelled or consumers fail to honour these, which is most likely a result of the harsh economic climate. We intend on following this trend in the new year.