Press release: For immediate release

Date: 11 November 2020

SA’s economic transactions stays on the recovery track

Higher activity levels in South Africa’s economic transactions continued to reflect signs of a recovery with the country’s growth rate on track to reach record levels in Q3 2020 and achieve strong upturn in the following quarter, according to BankservAfrica’s newly released October 2020 data.

“The BankservAfrica Economic Transactions Index (BETI) climbed to 122 index points in October 2020. This is the highest level to be reached since February 2020 and suggests the BETI has regained most of what it has lost since the nationwide lockdown and subsequent economic crash in the first few months,” says Shergeran Naidoo, Head of Stakeholder Engagements at BankservAfrica.

On a quarterly basis, the BETI improved by 15% over the last quarter and by 2% compared to September 2020. “Although the monthly improvement is the smallest since June 2020, it still indicates a recovery – albeit at a slower pace than before,” explains Naidoo.

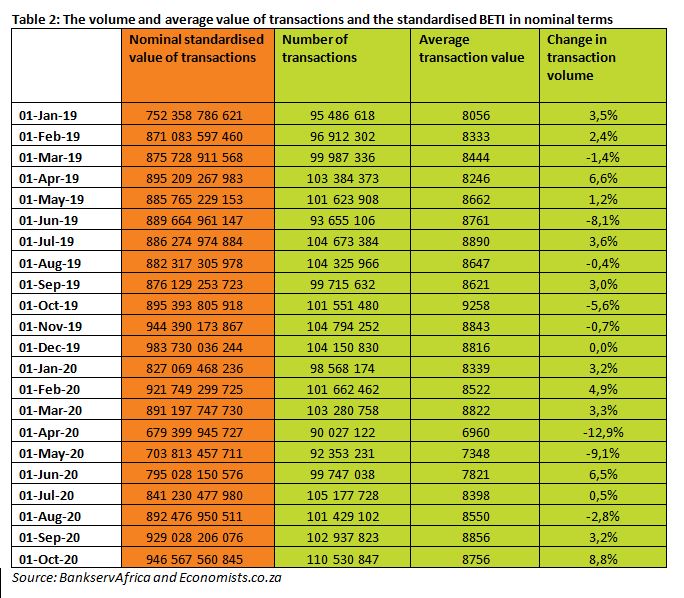

Over the last five months, there have been on average about 6.9 million more income transactions than in the same period last year, according to the BETI data. The number of transactions in October 2020 resulted in an all-time high of 110.5 million – an 8.8 increase on October 2019’s figures. As such, while the real value of the BETI increased by 2% on a year-on-year basis, the number of transactions increased by nearly 9% over the same period.

“This is certainly unusual; we believe this increase was largely driven by the COVID-19 Social Relief Distress special grant pay-outs and some COVID-19 UIF TERS payments,” says Mike Schüssler, Chief Economist at economists.co.za. “This additional money spilled over into the economy as affected and cash-strapped consumers were given some respite by government to cover their household expenditure and supplement lost incomes. These certainly helped to keep the economy flowing.”

The BETI shows in the quarter to October 2020, the number of transactions increased by 3.5% compared to the quarter to July 2020. The last two months reflect the strongest increases since July 2020. How these translate in value can be seen in our June 2020 to October 2020 data where the value of these extra payments processed through BankservAfrica was at least R66 billion – or about 12% of all income stream payments. With some of the TERS payments made via the normal EFT system, we believe the total could be closer to R80 billion for payments made through BankservAfrica.

“The total in extra payments is estimated to be around 5% of the cumulative transactions that make-up the BETI over the last five months. So, while the income stream share was 12%, the share of the overall BETI was much smaller at around 5% on average,” explains Schüssler.

As the extra relief payments slowly fade away, the BETI is expected to decline by between 4-5%. Schüssler adds: “This will not be as significant as the intense lockdown period but the elimination of these extra payments will have a small, yet significantly negative impact on the SA economy.”

“With some of these pay-outs still being made, we may see consumer spending pick up in the near-term for Black Friday and Cyber Monday where we’re already seeing some retailers offering in-store sales over a month or by week to entice consumers. Others may take the option of online shopping for retailers that offer big sales over the two days,” says Naidoo.

“Overall, October 2020 was a very strong month and provides a good indication that the economy is edging closer to the level it was before the lockdown. However, much of this recovery has been built on government’s support through relief payments. Therefore, this growth may not be sustainable into the long-term when these payments cease,” says Schüssler. “Although we expect Q3 2020 GDP growth to be the best on record since 1960, we anticipate a small growth decline in the first part of 2021 due to the retraction of the TERS and SRD pay-outs.”

Ends

Contact Leigh-Anne Sa Joe for more information: Leigh-AnneS@Bankservafrica.com or (011) 497 4347.

Notes to the Editor:

The BETI stands for the BankservAfrica Economic Transaction Index. BankservAfrica is a payment enabling organisation operating between the various South African banks with a very secure messaging environment in place. Economists.co.za is an economic consultancy that helped develop the BETI.

The BETI is a very fast and broad overview of current economic trends over a broad range of sectors, making use of economic transactions as captured by BankservAfrica. Like the Swift Index, the BETI is considered a “now-cast” number as a result of its speedy ability to convey the overall economic conditions to the market. Where most economic indicators can take anything between 38 and 76 days to become public knowledge, now-cast indicators take less than a month after the facts were revealed to come to the market.

The BETI is also the broadest of the “now-cast” indicators to come to the market, as it covers economic transactions across the whole economy. Very big distortive economic transactions do not form part of the BETI. This is also on its own a trend-strengthening indicative factor.

About BankservAfrica

BankservAfrica is the trusted payments partner and Financial Markets Infrastructure (FMI) to the financial services industry. As the largest automated payments clearing house in Africa we clear and process billions of low value card, ATM and EFT transactions annually. Our role in the South African National Payments System (NPS) is to facilitate interoperability between the banks and ensure regulatory compliance with our regulators against international banking security best practice and standards and reduces risk and complexity in the industry.

We continue to strive to be a world class and pre-eminent payments operator, innovator and payments partner of choice in Africa, by simplifying our worlds through combining trusted transactions with sensitive information.

BankservAfrica’s national responsibility is to provide safe financial payment services for 56.7 million South Africans, irrespective of their location in partnership with our shareholders and partners.

With a 48-year history in South Africa, BankservAfrica operates 24/7, 365 days a year and delivers on very strong SLAs.

October 2020 BETI report to accompany press release

Date: 11 November 2020

Is the BETI supported by extra TERS and SASSA payments?

While a number of economic forecasts are predicting South Africa’s Q3 2020 will hold the strongest growth quarter on record, we are seeing the last quarter of 2020 beginning on a strong footing in the BankservAfrica Economic Transactions Index (BETI) data for October 2020.

The BETI for October 2020 reached 122 index points – the highest level since February 2020. However, the monthly increase of 2% is the smallest since June 2020, showing that although the economic pick-up continues, it is not as fast, as recorded in the previous months. Still, the BETI has managed to regain most of what it lost since the initial lockdown economic crash. On a quarterly basis, the BETI improved by 15% over the last quarter.

Overall, October 2020 was a very strong month and the best indication that the economy is edging closer to the level it was before South Africa’s nationwide lockdown.

The BETI is extremely strong – what’s the story behind it?

Over the last five months, there have been on average about 6.9 million more income transactions than in the same period last year. Owing to how we measure and compile the BETI, some of these transactions are excluded but feature in our monthly BankservAfrica Take-home Pay Index, as well as to the BankservAfrica Private Pensions Index (we do not add the COVID-19 Social Relief Distress special grant pay-outs and some COVID-19 UIF TERS payments are excluded).

This may have resulted in the number of transactions reaching an all-time high of 110.5 million in October 2020, which was an 8.8% increase on October 2019. Therefore, the real value of the BETI increased by 2% year-on-year while the number of transactions increased by nearly 9% over the same period – or more than four times the value of the number.

This is certainly unusual; the last time the number of transactions increased at this rate was in October 2018.

We believe this was driven by an increase in TERS and SRD grant payments. We do not include these payments in the actual BETI but, as individuals tend to spend this additional relief money in the rest of the economy, the result is the ‘spill over’ effect in the BETI data. The increases in the BETI from the extra income and salaried payments saw Electronic Fund Transfer Credit (EFTC) payments, in particular, increase by nearly 12% over the last two months compared to a year ago.

What we have picked up in the transaction data (leaving out the actual value) shows that in the quarter to October 2020, the number of transactions increased by 3.5% over the quarter to July 2020. As this leaves out the April 2020 low, it does not indicate that more transactions were processed. The last two months have shown the strongest increase since July 2012.

In analysing the income and salary side, including the SASSA payments (which are excluded from the BETI), we see there was an extra 6.9 million transactions per month at an average value of R1 910 per month. We think this indicates that the TERS and SRD grant payments could have averaged this amount as the average for salaries and SASSA payments would usually be around R5 100 per month.

Our data shows from June 2020 to October 2020, the value of these extra payments processed through BankservAfrica was at least R66 billion – or about 12% of all income stream payments.

Added to this, some TERS payments were paid via the normal EFT system, not the EFT income side. We believe that the total would be closer to R80 billion for payments made through BankservAfrica.

The total in extra payments is estimated at around 5% of the cumulative transactions that make-up the BETI over the last five months. So, while the income stream share was 12%, the share of the overall BETI was much smaller at around 5% on average.

These extra payments will slowly fade away from here on. The TERS applications have already ceased while the extra SASSA grants will stop in January 2021.

So, what do the extra income payments mean?

We believe that the BETI will see a decline of around 4% to 5% as these extra payments get withdrawn. This will not be as big as the dive seen in the lockdown period, but the removal of the extra payments will have a small, yet significantly negative impact on the SA economy. In the near-term, we may see consumer spending on the rise for Black Friday and Cyber Monday as some in-store retailers have opted to run month-long or weekly sales to keep in line with the COVID-19 social distancing while others prepare for major online spend over the usual long weekend of sales in late November 2020.

The extra money flowing into the South African economy makes the economy look stronger, but the fact is much of this is from loans that must be paid back over time. It is therefore impossible to expect these payments to be able to continue at its current pace. As such, although there is a recovery, it is not sustainable into the long-term when these payments cease. It will be difficult to cut back on the social relief pay-outs, but it will be economically impossible to continue at this rate while tax revenue remains under pressure.

To sum it up, we expect there will be a small GDP decline in the first part of the new year due to the retraction of the UIF and SASSA payments.

Graph 1: Quarterly changes for transaction numbers

Source: BankservAfrica and Economists.co.za